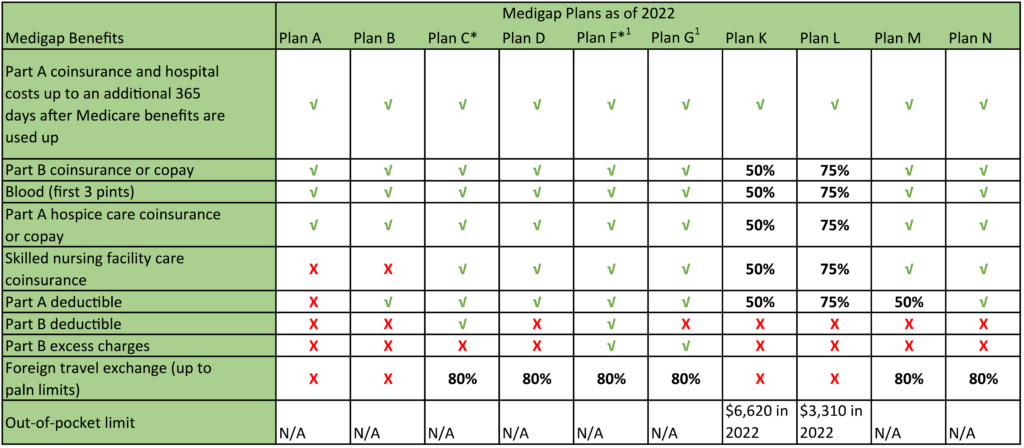

Medigap and Medicare Supplements

Get a free Medicare consultation and quote with no obligation to enroll

-

ADDRESS

805 N. Dobson Rd. Ste 111-1, Mesa, AZ 85201

-

PHONE

602-837-5959